High-Income Real Estate Purchasing New York: Strategies for Maximizing Returns

New York is one of the most vibrant and rewarding property markets in the world, offering a selection of chances for high-income financiers. From luxury condos in Manhattan to business residential properties in Brooklyn, the Empire State offers varied choices for those looking to create considerable returns on their investments. In this post, we'll explore approaches for high-income realty investing in New York, the kinds of residential or commercial properties that assure strong returns, and pointers for navigating the intricacies of this competitive market.

Why Buy New York Property?

1. Strong Need and High Home Worths:

New York's property market is characterized by solid demand and continually high residential or commercial property worths, particularly in in-demand locations like Manhattan, Brooklyn, and Long Island. This need is driven by the city's standing as a worldwide financial center, a hub for society and entertainment, and a preferable area for both domestic and worldwide customers. For investors, this equates right into the potential for considerable rental revenue and property gratitude with time.

2. Diverse Financial Investment Opportunities:

New york city supplies a large range of real estate investment chances, from houses like deluxe apartments and multi-family buildings to commercial areas, retail properties, and industrial storehouses. Whether you want generating passive income with rentals or trying to find funding recognition, the state's varied market accommodates various financial investment approaches.

3. Durability in Economic Downturns:

Historically, New york city realty has actually revealed durability throughout economic slumps. Also during periods of market volatility, prime places in the state, particularly in New york city City, have actually kept their worth far better than various other markets. This durability makes New York a much safer bet for high-income real estate investors looking to minimize threat while making the most of returns.

Key Strategies for High-Income Property Buying New York City

1. Focus on Luxury Properties:

Investing in deluxe realty, especially in neighborhoods like Manhattan's Upper East Side, Tribeca, and SoHo, can yield significant returns. These locations draw in high-net-worth individuals happy to pay costs prices for special homes. Luxury apartments, penthouses, and condominiums in these neighborhoods often value quicker than the broader market and command greater rental rates, ensuring a consistent and substantial revenue stream.

2. Check Out Commercial Real Estate:

Business residential or commercial properties in New york city, including office buildings, retail areas, and mixed-use growths, use high-income potential because of their prime areas and long-term lease arrangements. Locations like Midtown Manhattan, Midtown Brooklyn, and the Financial District are specifically attractive for financiers wanting to take advantage of the city's commercial real estate need. These residential properties commonly use secure, long-lasting revenue with renters like firms, retailers, and organizations.

3. Buy Multi-Family Units:

Multi-family homes, such as apartment and domestic complicateds, are a prominent option for high-income investor in New York. These residential or commercial properties benefit from the city's high rental demand, driven by a growing populace and a scarcity of budget-friendly real estate. Multi-family units supply a regular capital, and with the right management, they can likewise use chances for value-add renovations, better increasing rental income and home worth.

4. Take Into Consideration Short-Term Rentals:

Temporary rental properties, especially in tourist-heavy areas like Manhattan, Brooklyn, and the Hamptons, can generate considerable earnings. Platforms like Airbnb and VRBO have made it much easier for financiers to handle temporary leasings and make best use of tenancy prices. While these buildings call for even more hands-on monitoring, the possibility for high every night prices and boosted profits during peak seasons makes them an attractive option for high-income investors.

5. Take Advantage Of Chance Areas:

New York has several assigned Possibility Zones, which provide tax obligation incentives for financiers willing to establish buildings in these locations. These zones, located in neighborhoods like the South Bronx and parts of Brooklyn, existing opportunities for substantial returns via both rental earnings and home gratitude. Investing in Possibility Zones can also give considerable tax benefits, minimizing the overall tax obligation problem on your investment returns.

Sorts Of High-Income Quality in New York

1. Deluxe Condos and Penthouses:

High-end condos and penthouses in Manhattan and various other prime locations are amongst the most financially rewarding realty investments in New york city. These residential or commercial properties bring in rich customers and tenants, supplying high rental yields and substantial gratitude capacity. The exclusivity and high need for deluxe living in the city make these homes a keystone of high-income realty investing.

2. Business Office Spaces:

Purchasing office spaces in enterprise zone like Downtown and Downtown Manhattan uses high returns due to the constant need from corporations and services. The lasting leases usually related to commercial workplace supply security and predictable earnings, making them a reliable investment option.

3. Retail Properties:

New York is a worldwide purchasing location, and retail residential or commercial properties in high-traffic areas can produce significant rental income. Characteristic along popular purchasing hallways like Fifth Avenue, Madison Avenue, High-income real estate investing new york and SoHo are particularly useful, as they bring in both neighborhood customers and tourists.

4. Multi-Family Residential Buildings:

As discussed earlier, multi-family domestic buildings are a staple in New york city's high-income realty market. These residential properties satisfy the city's expanding populace, offering investors consistent rental income and opportunities for value gratitude.

5. Mixed-Use Developments:

Mixed-use developments that combine residential, retail, and office spaces are increasingly preferred in New york city. These buildings supply numerous earnings streams, making them a robust investment option. Locations like Hudson Yards and the Brooklyn beachfront are archetypes of successful mixed-use developments that attract high-income capitalists.

Tips for Success in High-Income Property Investing

1. Conduct Thorough Market Research:

Before spending, it's crucial to conduct comprehensive marketing research to comprehend the dynamics of the New York property market. Examine trends in property worths, rental rates, and need in various neighborhoods. Focus on locations with solid economic development, infrastructure growth, and high demand for domestic or industrial rooms.

2. Collaborate With Experienced Professionals:

Browsing New York's property market can be intricate, so it's important to work with seasoned real estate professionals, property supervisors, and legal experts. These specialists can offer valuable insights, help you identify profitable investment chances, and ensure that all deals are taken care of smoothly.

3. Expand Your Profile:

Diversifying your realty portfolio throughout various residential or commercial property types and locations within New York can aid mitigate danger and boost overall returns. Take into consideration balancing luxury properties with business investments or discovering arising areas with high development possibility.

4. Stay Informed on Market Trends:

The New york city real estate market is vibrant and constantly advancing. Keep educated about the most recent market trends, regulative changes, and economic signs that can affect your investments. Being positive and versatile will assist you maximize brand-new chances and make educated choices.

5. Take Into Consideration Long-Term Value:

While https://greenspringscapitalgroup.com/ high-income real estate investing typically focuses on instant returns, it's additionally necessary to think about the lasting worth of your financial investments. Residence in prime locations with strong recognition potential can significantly enhance your wealth gradually, offering both revenue and funding gains.

Conclusion

High-income realty investing in New york city provides a path to considerable riches creation, with chances across deluxe houses, commercial rooms, and multi-family devices. By focusing on prime places, conducting detailed market research, and leveraging expert proficiency, financiers can maximize their returns and develop a robust property portfolio in among the world's most vibrant markets.

Whether you're a skilled financier or simply starting, New york city's real estate market offers numerous possibilities for generating considerable income and lasting value. Discover the high-income realty market in New york city today and take the primary step towards constructing a prosperous economic future.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Robbie Rist Then & Now!

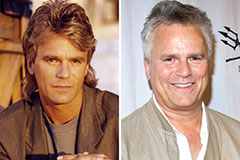

Robbie Rist Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!